Bausch + Lomb is an eye health products company based in Laval, Quebec, Canada. It is one of the world's largest suppliers of contact lenses, lens care products, pharmaceuticals, intraocular lenses, and other eye surgery products.

Bausch + Lomb, the first of two businesses being spun out by Bausch Health Cos., was seen as a test of whether a stable, profitable business could help break the ice for dozens of companies waiting in the wings to go public.

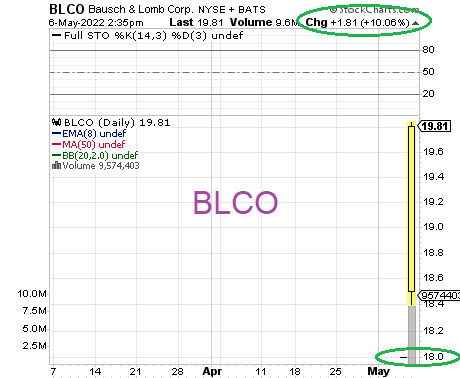

Shares of the contact lens and eye-care company opened trading Friday at $18.50, after selling for $18 in the IPO. They closed at $20 in New York trading, giving the company a market value of $7 billion.

Bausch Health will get the proceeds from the IPO as the selling shareholder, according to filings with the U.S. Securities and Exchange Commission. Bausch Health had aimed to raise as much as $840 million at the top of the $21 to $24 price range.

CEO Moves

With the spinoff, Joseph Papa has moved from chief executive officer of Bausch Health to CEO and chairman of Bausch + Lomb. Thomas Appio has been appointed to replace him as the top executive at Bausch Health, according to a statement. Papa will remain chairman of Bausch Health.

In an effort to raise money to pay off tens of billions in debt on its books from that era, Bausch Health is also planning to spin off its Solta Medical skin-care unit. Bausch Health, which is keeping its core pharmaceutical operations, had about $23 billion in total debt as of Dec. 31.

Solta Spinoff

Solta submitted its IPO filing to the SEC in February but hasn’t moved ahead with proposed terms for its share sale. For the nine months ended Sept. 30, Solta had net income of $72.8 million on revenue of $219 million, according to its filing.

Bausch + Lomb, based in Vaughan, Ontario, reported $65 million in net income on $3.8 billion in revenue on a pro forma basis in 2021. In addition to contact lenses and solutions under brands including Ocuvite, PureVision and Biotrue, the company also makes ophthalmic pharmaceuticals for ailments such as glaucoma, as well as surgical tools and devices.

Bausch + Lomb’s offering is topped in the U.S. this year only by private equity firm TPG Inc.’s $1.1 billion listing in January, according to data compiled by Bloomberg.

No comments:

Post a Comment