Sector(s): Consumer Defensive

Industry: Education & Training Services

Full Time Employees: 1,238

Incorporated in 2010

HQ in San Francisco, California

https://www.udemy.com

Friday, October 29, 2021

Udemy (UDMY) began trading on the Nasdaq on Fri 29 Oct 21

Thursday, October 28, 2021

CareDx Inc. (CDNA) reported earnings on Thur 28 Oct 21 (a/h)

- For Q3, co posted upside results for EPS and for revs, which rose +42% yr/yr to $75.6 mln. Testing services volume grew +86% yr/yr. Raised its guidance for FY21 revs to $290-293 mln, in-line with estimates. Falls to 52-week lows.

** charts after earnings **

CareDx beats by $0.05, beats on revs; raises FY21 revs in-line

- Reports Q3 (Sep) earnings of $0.07 per share, excluding non-recurring items, $0.05 better than the S&P Capital IQ Consensus of $0.02; revenues rose 41.6% year/year to $75.6 mln vs the $74.11 mln S&P Capital IQ Consensus.

- Co issues raised guidance for FY21, sees FY21 revs of $290-293 mln from $280-290 mln vs. $290.48 mln S&P Capital IQ Consensus.

Wednesday, October 27, 2021

Rent the Runway (RENT) began trading on the Nasdaq on Wed 27 Oct 21

- Sector(s): Consumer Cyclical

- Industry: Apparel Retail

- Full Time Employees: 958

- Incorporated in 2009

- Headquartered in Brooklyn, New York

- https://www.renttherunway.com

Ticker: RENT

Rent the Runway priced upsized 17.0 mln share IPO at $21/share, at the high end of the $18-21 expected range

Opened at $23 after pricing IPO at $21

Friday, October 22, 2021

Tufin (TUFN) : 30-month performance

- April 6, 2022: Tufin to be acquired by software-focused investment firm Turn/River Capital for $570 million in an all-cash deal.

Labels:

30-month performance,

mergers & acquisitions,

TUFN,

Turn River

Thursday, October 21, 2021

Ventyx Biosciences (VTYX) began trading on the Nasdaq on Thur 21 Oct 21

Ventyx Biosciences, Inc., a clinical-stage biopharmaceutical company, develops small molecule product candidates to address a range of inflammatory diseases.

- Sector(s): Healthcare

- Industry: Biotechnology

- Full Time Employees: 44

- Incorporated in 2018

- HQ: Encinitas, California

- https://ventyxbio.com

Ventyx Biosciences priced upsized 9,472,656 share IPO at $16/share, at the midpoint of the $15-17 expected range

Opened at $18.65

Oatly Group AB (OTLY) : 5-month performance

ticker: OTLY

TScan Therapeutics (TCRX) began trading on the Nasdaq on Fri 16 July 21

TScan Therapeutics (TCRX) has priced its IPO of ~6.7M shares of common stock at $15.00/share, for gross proceeds of $100M.

The company initially filed to offer 6.25M shares at a price range of $15-$17.

- TScan is a biopharmaceutical company focused on the development of T-cell receptor engineered T cell therapies (TCR-T) for the treatment of patients with cancer.

- The company’s lead liquid tumor TCR-T therapy candidates, TSC-100 and TSC-101, are in development for the treatment of patients with hematologic malignancies to eliminate residual leukemia and prevent relapse after hematopoietic stem cell transplantation.

- TCRX is also developing multiplexed TCR-T therapy candidates for the treatment of various solid tumors.

- The company plans to submit IND applications for each of TSC-100 and TSC-101 with the FDA in Q4 2021.

Labels:

2021 IPOs,

3-month performance,

biotech IPOs,

NASDAQ,

TCRX

Portillo's (PTLO) began trading on the Nasdaq on Thur 21 Oct 21

Portillo's Inc. owns and operates fast casual and quick service restaurants in the United States. The company offers Chicago-style hot dogs and sausages, Italian beef sandwiches, burgers, chopped salads, crinkle-cut French fries, homemade chocolate cakes, and milkshakes. As of June 26, 2022, it owned and operated 71 Portillo's restaurants across nine states.

- Sector(s): Consumer Cyclical

- Industry: Restaurants

- Founded in 1963

- HQ in Oak Brook, Illinois

- https://www.portillos.com

Portillo's priced 20.3 mln share IPO at $20.00 per share, at the high end of the $17-20 expected range

Opened at $26

Wednesday, October 20, 2021

Online learning firm Udemy targets nearly $4 bln valuation

Oct 20 (Reuters) - Udemy Inc, which has grown rapidly over the past 18 months as demand for online learning surged during the pandemic, on Wednesday set terms for its initial public offering in New York, targeting a valuation of up to $4 billion from the share sale.

The company is the latest in a string of online education firms looking to cash in on the demand for new listings in the U.S., after Coursera Inc (COUR) and Nerdy Inc (NRDY) went public earlier this year.

San Francisco-based Udemy is looking to raise up to $420.5 million at the top end of its price range of $27 to $29 per share, according to a filing.

The company, which provides over 183,000 courses in 75 languages across more than 180 countries, earlier this year launched a direct-to-consumer subscription that is still in beta testing mode.

Morgan Stanley and J.P. Morgan are the lead underwriters for the offering.

Udemy plans to list on the Nasdaq under the symbol "UDMY".

Thursday, October 14, 2021

GitLab (GTLB) began trading on the Nasdaq on Thur 14 Oct 21

GitLab provides collaboration software for programmers.

- Sector(s): Technology

- Industry: Software—Application

- Founded in 2011

- Headquartered in San Francisco, California

- Full Time Employees: 1,630

- https://about.gitlab.com

GitLab opened at $94.25 after pricing IPO at $77

3 days later:

Monday, October 11, 2021

EverCommerce (EVCM) began trading on the Nasdaq on Thur 1 July 21

EverCommerce Inc., together with its subsidiaries, provides integrated software-as-a-service solutions for service-based small and medium sized businesses.

The company was formerly known as PaySimple Holdings, Inc. and changed its name to EverCommerce Inc. in December 2020.

- Sector(s): Technology

- Industry: Software—Infrastructure

- Full Time Employees: 2,300

- Incorporated in 2016

- Headquartered in Denver, Colorado

- https://www.evercommerce.com

Labels:

2021 IPOs,

3-month performance,

EVCM,

NASDAQ,

software IPOs,

tech IPOs

Saturday, October 9, 2021

Volvo Cars seeks to raise $2.9 billion in IPO

- Stockholm listing would represent one of the car industry’s most striking turnarounds

- It could value the company at upward of $25 billion.

Volvo Car Group AB will look to raise at least 25 billion kronor ($2.9 billion) in an initial public offering the company is forging ahead with despite the global chip shortage.

Proceeds will help the Swedish carmaker owned by China’s Zhejiang Geely Holding Group Co. fund its shifts to fully electric cars and a direct-to-consumer sales and subscription model, the company said in a statement Monday. Geely intends to remain its largest shareholder, with the first day of trading planned for this year.

Volvo’s plan to sell shares got a boost from Polestar, the electric car company backed by the Swedish automaker and Geely, which last month agreed to go public via a blank-check firm at a roughly $20 billion valuation. Once the deal is completed, Volvo expects to own close to 50% of the combined company.

Volvo’s IPO could value the company at about $20 billion, and at between $25 billion and $30 billion including the Polestar stake, according to a person familiar with the matter.

Polestar’s listing will be a “very big help for investors to really see the full value of Volvo, including this relationship with Polestar,” Chief Executive Officer Hakan Samuelsson said in an interview. He declined to comment on valuation.

The decision to list puts Volvo, founded in 1927 in Gothenburg, neck-and-neck with the four-year-old EV maker that will use the incumbent manufacturer’s production network. Volvo last year sold some 660,000 cars, and Polestar aims to deliver 29,000 vehicles in 2021 before adding new models to significantly grow its footprint.

NerdWallet (NRDS) files S-1 for IPO

- Morgan Stanley, KeyBanc Capital Markets, BofA Securities, Barclays, Citigroup, Truist, William Blair, and Oppenheimer are acting as underwriters for the offering.

- For YE2020 company reported total revs of $245.3 mln, +7.4% yr/yr, net income per share of $0.05; monthly unique users for YE2020 was 16 mln, +23% yr/yr.

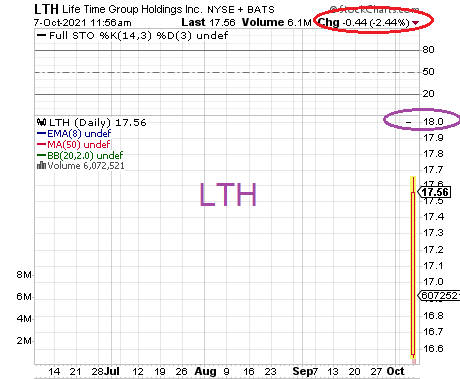

Thursday, October 7, 2021

Life Time Group Holdings (LTH) began trading on the NYSE on Thur 7 Oct 21

Life Time Group Holdings, Inc. owns and manages fitness and recreational sports centers in the United States.

- Sector(s): Consumer Cyclical

- Industry: Leisure

- Full Time Employees: 39,000

- Founded in 1992

- Headquartered in Chanhassen, Minnesota

- https://www.lifetime.life

Subscribe to:

Posts (Atom)