Toast, Inc. operates a cloud-based technology platform for the restaurant industry in the United States and Ireland. Its products are used at more than 48,000 restaurant locations.

- Sector(s): Technology

- Industry: Software—Infrastructure

- Full Time Employees: 1,900

- HQ: Boston, Massachusetts

- http://pos.toasttab.com

The IPO valued the restaurant-tech company at $20 billion

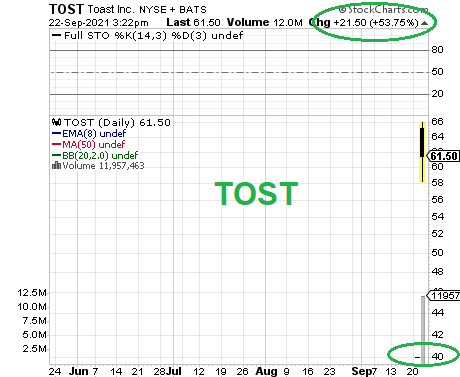

Toast opened at $65.26 after pricing 21.7 mln share IPO at $40/share, above the raised $34-36 expected range

Toast priced its IPO at $40 on Tuesday, above the expected price range of $34 to $36.

Annual recurring revenue surged 118% in the second quarter from a year earlier to $494 million as more restaurants adopted the company’s contactless payment technology.

Toast’s IPO valued the company at $20 billion, up from a valuation of $8 billion in a secondary share sale late last year.

The company raised about $870 million in its IPO, selling shares at $40 each. Toast previously said it expected to price the offering at $34 to $36, following an initial range of $30 to $33.

The stock opened at $65.26, boosting Toast’s market cap to over $32.5 billion.

Toast’s IPO comes amid a business resurgence for a company that was devastated in the early days of the pandemic, when restaurants were forced to close their doors and cities across the country shut down. In April 2020, Toast slashed half its workforce, and CEO Chris Comparato wrote in a blog post that the prior month, “as a result of necessary social distancing and government-mandated closures, restaurant sales declined by 80 percent in most cities.”

Toast CEO and co-founders

Toast was founded in 2011 by Steve Fredette, Aman Narang, and Jonathan Grimm, three veterans of Endeca, the enterprise software company sold to Oracle for $1.1 billion. Toast’s CEO is Christopher Comparato, another Endeca alum.

Founded in 2012 in Cambridge, Massachusetts, Toast started building payment technology for restaurants and eventually developed a full point-of-sale system. Prior to the Covid-19 pandemic, Toast was thriving by helping restaurants combine their payment systems with things like inventory management and multilocation controls for eateries with more than one site. Investors valued the company at $5 billion in February 2020.

No comments:

Post a Comment