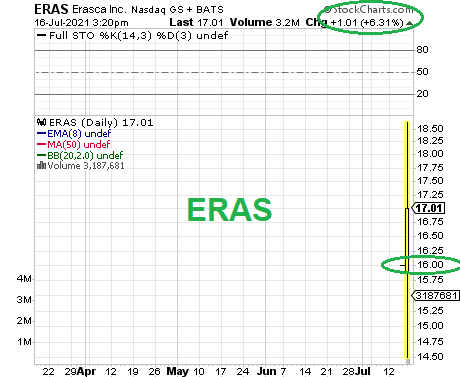

Erasca priced upsized 18.8 mln share IPO at $16/share, at the high end of the $14-16 expected range

Erasca is a precision oncology company working to develop new anti-cancer drugs. The company is following multiple strategies in its research, to discover, develop, and eventually commercialize new medication therapies for RAS and MPAK pathway cancers. Erasca has a pipeline of 9 separate drug candidates.

The lead candidate in the pipeline, EARS-007, is being studied as a treatment for various solid and liquid tumors, as well as non-small cell lung cancer. The drug has four separate tracks under investigation, with one (the tissue agnostic RAS/MPAK altered solid tumor track) entering a Phase 1b/2 clinical trial, the HERKULES-1 trial. The other indications for this drug candidate are the subjects of HERKULES 2 through 4, which are planned to start later this year.

No comments:

Post a Comment