Friday, July 30, 2021

Riskified (RSKD) began trading on the NYSE on Thur 29 July 21

Thursday, July 29, 2021

Robinhood Markets (HOOD) began trading on the Nasdaq on Thur 29 Jul 21

- Sector(s): Technology

- Industry: Software—Infrastructure

- Full Time Employees: 2,300

- Founded: Apr 18, 2013

- Headquartered: Menlo Park, California

- CEO: Vladimir Tenev

- https://robinhood.com

Wednesday, July 28, 2021

Oscar Health (OSCR) began trading on the NYSE on Wed 3 March 21

Oscar Health is a provider of health insurance coverage serving individuals, families, small businesses, and Medicare users. According to Reuters, the company currently provides for 529,000 customers on its technology platform across 18 states.

In 2020, the company said that its customers increased year-over-year by 75%, thanks to the pandemic increasing the demand for healthcare delivery through online, mobile and at-home methods. The insurtech’s premiums also increased last year to $1.67 billion, representing a 60% increase from the previous year.

- Co-founded by Josh Kushner in 2012, the managing partner of the venture capital firm Thrive Capital, and the son of billionaire real estate developer Charles Kushner.

- Oscar Health made headlines in 2018, when Google parent company Alphabet took an almost 10% stake in the health insurance startup for $375 million.

- The company was named after Kushner’s great-grandfather, an immigrant given the name Oscar at Ellis Island, according to a letter in the filing from Kushner and co-founder Mario Schlosser.

Alset EHome (AEI) Prices Public Offering of Shares, Warrants

Tuesday, July 27, 2021

Waterdrop (WDH) began trading on the NYSE on Fri 7 May 21

- Sector(s): Financial Services

- Industry: Insurance—Diversified

- Full Time Employees: 4,291

- Founded in 2016

- Headquartered in Beijing, China

- http://www.waterdrop-inc.com

Inovalon (INOV) to be acquired by Nordic Capital?

- Update: Acquired by Nordic Capital and Insight Partners for $7.3 Billion. (Aug 19, 2021)

ironSource (IS) began trading on the NYSE on Tue 29 June 21

- Number of employees: 1000+

- Number of locations: 12

- Founder: Tomer Bar-Zeev

- Headquarters: Israel

- Founded: 2009, Tel Aviv-Yafo, Israel

- Subsidiaries: Luna Labs Limited, Soomla Inc., Upopa Games, AfterDownload Ltd.

- CEO Tomer Bar-zeev

- is.com

Founded in 2009, IronSource is based in Tel Aviv, with additional offices in San Francisco, New York, London, and other locations in China, India and South Korea. Originally a downloads optimization software developer, IronSource shifted its focus to rewarded ads following a series of acquisitions between 2013 and 2016. The company has raised $105 million to date.

Aside from company employees, IronSource’s shareholders include Israel-based Viola Ventures, Los-Angeles-based Saban Ventures, the venture arm of the Saban Group, Allied Holdings, the controlling shareholder of Champion Motors Israel, and Arik Czerniak, co-founder of app monetization company Supersonic, which was acquired by IronSource in 2015.

Saturday, July 24, 2021

IPOs this week : July 26 - 30, 21 (wk 30)

- Dole (DOLE), Duolingo (DUOL), MeridianLink (MLNK), Snap One (SNPO), Context Therapeutics (CNTX), Riskified (RSKD) and Preston Hollow Community Capital (PHCC) on July 28.

- Robinhood Markets (HOOD) is also expected to start trading after its direct listing. Menlo Park, Calif., 55 million shares, priced $38-$42, managed by Goldman Sachs/JP Morgan. Business: Offers a no-commission retail brokerage platform.

- Aspire Global (NASDAQ:ASPG) - 15 million shares, priced $7-$9, managed by Tiger Brokers/EF Hutton. Business: E-cigarette and vaping brand.

- Clarios (NYSE:BTRY) - Milwaukee, 88.1 million shares, priced $17-$21, managed by BofA Securities/JP Morgan. Business: Global manufacturer of low-voltage vehicle batteries.

- Didi Global (NYSE:DIDI), SentinelOne (NYSE:S), Legalzoom (NASDAQ:LZ), Krispy Kreme (NASDAQ:DNUT), Xometry (NASDAQ:XMTR), EverCommerce (NASDAQ:EVCM), Intapp (NASDAQ:INTA), Torrid Holdings (NYSE:CURV), CVRx (NASDAQ:CVRX), Aerovate Therapeutics (NASDAQ:AVTE), DingDong Cayman (NYSE:DDL), Better Choice Co Inc (OTCQX:BTTR), Pop Culture Group (NASDAQ:CPOP), Glimpse Group (NASDAQ:VRAR), Recruiter Group (NASDAQ:RCRT) and Eco Wave Power Global (NASDAQ:WAVE).

Friday, July 23, 2021

Xponential Fitness (XPOF) began trading on the NYSE on Fri 23 July 21

- Sector(s): Consumer Cyclical

- Industry: Leisure

- Full Time Employees: 240

- Founded in 2017

- Headquartered in Irvine, California

- http://www.xponential.com

Paycor (PYCR) began trading on the Nasdaq on Wed 21 July 21

- Sector(s): Technology

- Industry: Software—Application

- Full Time Employees: 1,945

- founded in 1990 and is headquartered in Cincinnati, Ohio.

- Chief Executive Officer Raul Villar Jr.

- http://www.paycor.com

- Funds controlled by private equity firm Apax Partners will own 82% of its common stock after its listing.

Thursday, July 22, 2021

Zevia PBC (ZVIA) began trading on the NYSE on Thur 22 July 21

- Sector(s): Consumer Defensive

- Industry: Beverages—Non-Alcoholic

- Full Time Employees: 98

- Founded in 2007

- HQ: Encino, California

- http://www.zevia.com

Tuesday, July 20, 2021

N-able Technologies (NABL) completes its spin-off from parent company SolarWinds (SWI)

- SolarWinds and N-able, a provider of cloud-based software solutions for managed service providers, today announced the completion of the previously announced spin-off of the SolarWinds managed service provider ("MSP") business into a standalone, separately-traded public company named N-able.

- Following the separation, which was completed on July 19, N-able will provide cloud-based software solutions for MSPs, enabling them to support digital transformation and growth within small and medium-sized enterprises. SolarWinds will retain its Core IT Management business focused primarily on providing IT infrastructure management software to corporate IT organizations.

Monday, July 19, 2021

Five9 (FIVN) to be acquired by Zoom (ZM) for $14.7 bln

- Zoom Video Communications (ZM) announced it has entered into a definitive agreement to acquire Five9 (FIVN) in an all-stock transaction valued at approximately $14.7 billion. Combining Five9's Contact Center as a Service solution with Zoom's broad communications platform will transform how businesses connect with their customers, building the customer engagement platform of the future.

- The acquisition is expected to help enhance Zoom's presence with enterprise customers and allow it to accelerate its long-term growth opportunity by adding the $24 billion contact center market. Five9 is a pioneer of cloud-based contact center software. Its highly-scalable and secure cloud contact center delivers a comprehensive suite of easy-to-use applications that allows management and optimization of customer interactions across many different channels.

- As part of the agreement, Five9 stockholders will receive 0.5533 shares of Class A common stock of Zoom Video Communications, Inc. for each share of Five9, Inc. Based on the closing share price of Zoom Class A common stock as of July 16, 2021, this represents a per share price for Five9 common stock of $200.28 and an implied transaction value of approximately $14.7 billion.

- The Boards of Directors of Zoom and Five9 have approved the transaction. The Board of Directors of Five9 recommends that Five9 stockholders approve the transaction and adopt the merger agreement. The transaction, which is anticipated to close in the first half of calendar year 2022, is subject to approval by Five9 stockholders, the receipt of required regulatory approvals and other customary closing conditions.

IPOs this week : July 19 - 23, 2021 (wk 29)

- Paycor HCM (NASDAQ:PYCR),

- Xponential Fitness (XPOF)

- Vtex (NYSE:VTEX),

- CS Disco (NYSE:LAW),

- Kaltura (NASDAQ:KLTR),

- Gambling Group (NASDAQ:GAMB),

- Ryan Specialty Group (NYSE:RYAN),

- Instructure (NYSE:INST),

- Zenvia (NASDAQ:ZENV),

- Couchbase (NASDAQ:BASE),

- Zevia (NYSE:ZVIA) and

- Outbrain (NASDAQ:OB).

- MYT Netherlands (NYSE:MYTE),

- Dream Finders Homes (NASDAQ:DFH),

- RLX Technology (NYSE:RLX),

- Patria Investments (NASDAQ:PAX),

- Montauk Renewables (NASDAQ:MNTK) and

- Huadi International Group (NASDAQ:HUDI).

Friday, July 16, 2021

Imago BioSciences (IMGO) began trading on the Nasdaq on Fri 16 July 21

- Imago BioSciences was founded in 2012

- HQ in Redwood City, California

- Hugh Y. Rienhoff, Jr., Founder and Chief Executive Officer

Opened at $17.50.

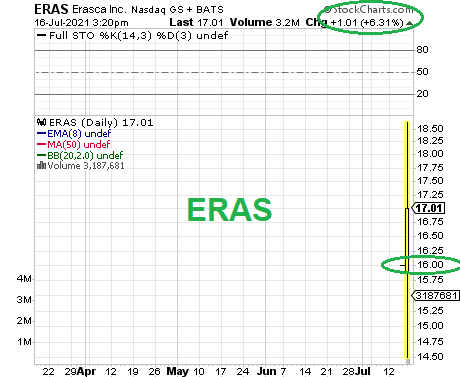

Erasca (ERAS) began trading on the Nasdaq on Fri 16 July 21

Monday, July 12, 2021

IPOs this week : July 12 - 16, 2021 (wk 28)

- Angel Oak Mortgage (AOMR), Convey Health (CNVY), Lyell Immunopharma (LYEL), Verve Therapeutics (VERV), and WalkMe (WKME) on July 12;

- Ambrx Biopharma (AMAM), Cyteir Therapeutics (CYT), Codex DNA (DNAY), Century Therapeutics (IPSC), AiHuiShou International (RERE), and Tremor (TRMR) on July 13.

- Affirm (AFRM) on July 12;

- Poshmark (POSH) on July 13; and

- Driven Brands (DRVN) and Playtika (PLTK) on July 14.

Friday, July 9, 2021

23andMe (ME) began trading on the Nasdaq on Thur 17 June 21

- Sector(s): Healthcare

- Industry: Diagnostics & Research

- Founded in 2006 and is

- Headquartered in Sunnyvale, California

- http://www.23andme.com

Anne Wojcicki, 23andMe co-founder & CEO (right) celebrates with 23andMe employees after remotely ringing the NASDAQ opening bell at the headquarters of DNA tech company 23andMe in Sunnyvale, California, U.S., June 17, 2021.

Far Peak Acquisition (FPAC) confirms intent to merge with Bullish

- Bullish, a unit of blockchain software company Block.one, plans to launch a regulated crypto exchange later this year.

- The company is backed by billionaire entrepreneur Peter Thiel's Thiel Capital and Founders Fund, British hedge fund manager Alan Howard, U.S. hedge fund manger Louis Bacon, Hong Kong billionaire Richard Li, German investor Christian Angermayer's Apeiron Investment Group, Galaxy Digital, and Japanese bank Nomura.

- Market sentiment on cryptocurrencies has dimmed as China, Britain and Japan clamp down on the sector.

- Bullish, a technology company focused on developing financial services for the digital assets sector, announced it intends to go public on the NYSE through a merger with Far Peak Acquisition Corp., a special purpose acquisition company.

- Bullish is preparing to release a regulated cryptocurrency exchange that offers deep, predictable liquidity with technology that enables retail and institutional investors to generate yield from their digital assets.

- In the coming weeks, Bullish exchange will run a private pilot program leading up to its public launch anticipated later in 2021.

- The business combination of Bullish and Far Peak has a pro forma equity value at signing of approx. US$9.0 bln at US$10 per share, to be adjusted at transaction closing based on crypto asset prices around that time.

- The proceeds include net cash in trust of approx. US$600 mln and US$300 mln of committed private investment in public equity anchored by EFM Asset Management, with participation from funds and accounts managed by BlackRock, Cryptology Asset Group, Galaxy Digital and several other institutional investors.

- The transaction is expected to close by the end of 2021.

Wednesday, July 7, 2021

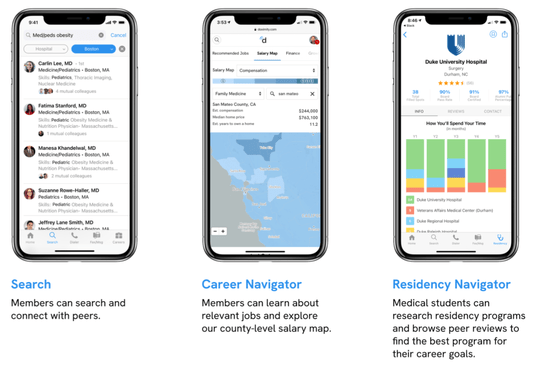

Doximity (DOCS) began trading on the NYSE on Thur 24 June 21

- Sector(s): Healthcare

- Industry: Health Information Services

- Full Time Employees: 953

- Incorporated in 2010

- Headquartered in San Francisco, California

- https://www.doximity.com

Monday, July 5, 2021

IPOs this week : July 5 - 9, 2021 (wk 27)

- Marqeta (NASDAQ:MQ),

- Kanzhun (NASDAQ:BZ),

- Monday.com (NASDAQ:MNDY),

- TaskUs (NASDAQ:TASK),

- Janux Therapeutics (NASDAQ:JANX),

- Zeta Global (NYSE:ZETA),

- 1stdibs (NASDAQ:DIBS),

- AcuityAds (NASDAQ:ATY),

- Zhangmen Education (NYSE:ZME) and

- Splash Beverage Group (NYSE:SBEV).

- Cullinan Oncology (NASDAQ:CGEM) and Gracell Biotechnologies (NASDAQ:GRCL) on July 7.