- DiamondPeak Holdings Corp. (DPHC) completed business combination with Lordstown Motors. The business combination was approved by DPHC stockholders in a special meeting held on October 22.

- Beginning on October 26, Lordstown Motors' Class A shares trade on the Nasdaq Global Select market under the ticker symbol "RIDE".

- Lordstown Motors, which unveiled the prototype of its flagship Endurance pickup truck in June 2020, remains on pace to commence commercial production in the second half of 2021 at its plant in Lordstown, Ohio.

Friday, October 30, 2020

Lordstown Motors (RIDE) began trading on the Nasdaq on Mon 26 Oct 20

Wednesday, October 28, 2020

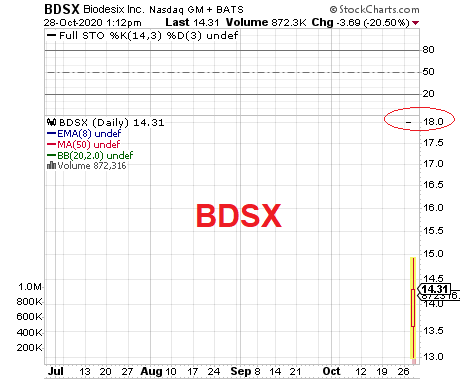

Biodesix (BDSX) began trading on the Nasdaq on Wed 28 Oct 20

- Sector(s): Healthcare

- Industry: Diagnostics & Research

- Full Time Employees: 200

- http://www.biodesix.com

Root Insurance (ROOT) began trading on the Nasdaq on Wed 28 Oct 20

- Root Insurance’s IPO is much larger than other insurtech company IPOs this year, including SelectQuote and Lemonade.

- Root Insurance uses an unusual pricing model that relies more on tracking applicants' driving habits than other auto insurers do.

Tuesday, October 27, 2020

Accolade (ACCD) began trading on the Nasdaq on Thur 20 Jul 20

- Sector(s): Healthcare

- Industry: Health Information Services

- Incorporated in 2007

- Headquartered in Seattle, Washington

- https://www.accolade.com

Monday, October 26, 2020

IPOs this week : October 26 - 30, 20 (wk 44)

- Amerihome (AHM) on October 28. The offering of 14.7M shares is expected to price in a range of $16 to $18.

- Biodesix (BDSX) also slated to price its IPO on October 28, with 4.17M shares due to go off in an expected range of $17 to $19.

- Allegro MicroSystems (ALGM), Caliber Home Loans (HOMS), Leslie's (LESL), Root (ROOT) and Mavenir (MVNR).

- Keep an eye on avocado pure-play Mission Produce (NASDAQ:AVO) with the analyst quiet period expiring following the company's IPO. Shares have shown a modest gain from the IPO pricing level of $12.

- IPO lockups expire on Sprout Social (NASDAQ:SPT), Lyra Therapeutics (NASDAQ:LYRA) and Zentalis Pharmaceuticals (NASDAQ:ZNTL).

Thursday, October 22, 2020

McAfee (MCFE) began trading on the Nasdaq on Thur 22 Oct 20

- The company, based in San Jose, California, was acquired by Intel Corp. in a 2010 deal. In 2016, Intel announced that it had signed an agreement to transfer a 51% stake in McAfee to the investment firm TPG for $1.1 billion. The transaction valued the spun-off company at $4.2 billion, including debt.

Current backers listed in McAfee’s prospectus include TPG, Intel, Singapore’s sovereign wealth fund GIC Pte and the private equity firm Thoma Bravo.

McAfee (MCFE) prices 37 mln share IPO at $20.00 per share, inside the expected range of $19-22

(Bloomberg) -- McAfee Corp. and its shareholders raised $740 million in an initial public offering priced within a targeted range as the cybersecurity software provider returns to the stock market.

The company and some of its investors sold 37 million shares for $20 apiece Wednesday, according to a statement. McAfee had marketed 31 million shares for $19 to $22, while its shareholders offered 6 million shares.

McAfee is valued in the IPO at about $8.6 billion based on the outstanding shares listed in its prospectus.

Loss to Profit

For the 26 weeks ended June 27, McAfee had net income of $31 million on revenue of $1.4 billion, according to its filings. That compared with a loss of $146 million on revenue of $1.3 billion for the comparable period last year.

The offering is being led by Morgan Stanley, Goldman Sachs Group Inc., TPG Capital BD, Bank of America Corp. and Citigroup Inc. McAfee’s shares are expected to begin trading Thursday on the Nasdaq Global Select market under the symbol MCFE.

The company was founded in 1987 by John McAfee. Since selling to Intel, McAfee has gone through a series of personal legal challenges.

He was a person of interest in a 2012 murder in Belize, though not charged with a crime. Last year, he was detained in the Dominican Republic for entering the country with a cache of firearms and ammunition.

The firearms charges were announced just hours after the U.S. Securities and Exchange Commission sued McAfee for promoting the sale of cryptocurrencies without disclosing that he was being paid to do so. This month, he was arrested on tax-evasion charges for allegedly failing to report that income.

Wednesday, October 21, 2020

Datto Holding (MSP) began trading on the NYSE on Wed 22 Oct 20

- Vista Equity Partners acquired Datto in 2017 for $1.3 billion and merged the company with Autotask. Vista will own 70.7% of Datto after the IPO, while Austin McChord, Datto’s founder, will have 13%.

Datto Holding (MSP) priced 22 mln share IPO at $27.00 per share, at the top end of the expected range of $24-27

Datto Holding, a backup-software company backed by Vista Equity Partners, priced at the high end of its initial public offering range, collecting roughly $550 million.

Late Tuesday, Datto sold 22 million shares at $27 each, the top of its $24 to $27 price range. Datto started trading Wednesday on the New York Stock Exchange under the symbol MSP.

Morgan Stanley, BofA Securities, Barclays and Credit Suisse are underwriters on the deal.

Datto is the latest software company to go public. Both Asana(Ticker: ASAN), which offers cloud-based project-management software, and Snowflake(SNOW), a cloud software company, made their debuts in late September. McAfee, the cybersecurity company, is expected to price its offering Wednesday night and begin trading on Thursday.

Founded in 2007, Datto provides business-continuity software, including backup and disaster recovery, that helps companies secure their data. Datto’s software is delivered through a managed-service-provider, or MSP, channel to small and medium-size businesses. The company had 17,000 MSP partners as of June 30, according to its prospectus. Datto said it helped restore more than 200 million software as a service objects in 2020, the prospectus said.

The company reported $10.1 million in profit for the six months ended June 30 on $249.1 million in revenue. This compares with $25.7 million in losses a year earlier on $215 million in revenue. Long-term debt stood at $577 million as of June 30. It has 1,653 employees as of June 30.

With 157,548,740 shares outstanding, Datto has a roughly $4.3 billion market cap, at $27 a share.

Vista Equity Partners acquired Datto in 2017 for $1.3 billion and merged the company with Autotask. Vista will own 70.7% of Datto after the IPO, while Austin McChord, Datto’s founder, will have 13%.

The Datto IPO comes just days since Robert Smith, Vista’s CEO, reached a $140 million settlement with the Justice Department, the Wall Street Journal reported. The nonprosecution agreement ends a yearslong U.S. tax investigation and calls for Smith to admit tax fraud as well as not properly filing foreign bank account reports, according to the Journal. Brian Sheth, Vista’s president and co-founder, is now looking to leave the firm, according to media reports.

Wins Finance (WINS) delisted from Nasdaq

- Sector(s): Financial Services

- Industry: Asset Management

- Full Time Employees: 24

- HQ: Beijing, China

- http://www.winsholdings.com

Monday, October 19, 2020

IPOs this week : October 19 - 23, 20 (wk 43)

- McAfee (NASDAQ:MCFE); 37M-share IPO prices in an expected range of $19 to $22. The company's FY19 financials included $2.64B in net revenue with a $236M net loss and adjusted EBITDA of $799M.

- Datto Holding (NYSE:MSP)

- Guild Holdings (NYSE:GHLD)

- Corsair Gaming (NASDAQ:CRSR) and Laird Superfood (NYSEMKT:LSF) on October 19;

- PMV Pharma (NASDAQ:PMVP), Prelude Therapeutics (NASDAQ:PRLD), Greenwich Lifesciences (NASDAQ:GLSI) on October 20.

- DraftKings (NASDAQ:DKNG)

- ORIC Pharmaceuticals (NASDAQ:ORIC)

Thursday, October 15, 2020

Array Technologies (ARRY) began trading on the Nasdaq on Thur 15 Oct 20

The solar ground monitoring system provider priced the upsized offering of 47.5M shares a dollar above its prior range.

The offering included 7M shares from Array and 40.5M from a selling shareholder.

Financials: 2019 sales totaled $647.9M (+123% Y/Y) with $39.7M in net income, up from the prior year's $60.8M loss. For H1 2020, revenue was $552.6M (+145%) with $76M net income.

Publicly-traded competitor: Gibraltar Industries (NASDAQ: ROCK), owner of solar racking company RBI Solar.

Wednesday, October 14, 2020

Codiak BioSciences (CDAK) began trading on the Nasdaq on Wed 14 Oct 20

- Codiak BioSciences priced 5.5 mln share IPO at $15, the mid-point of the $14-$16 expected price range, for gross proceeds of ~$82.5M.

- Underwriters' over-allotment is an additional 825K shares.

- Closing date is October 16.

- Goldman Sachs, Evercore ISI and William Blair are acting as joint book-running managers. Wedbush PacGrow is lead manager.

Tuesday, October 13, 2020

Opthea Limited plans an IPO

Opthea Limited, a biotechnology company focussed on retinal diseases, announced Sunday it is seeking an initial public offering in the United States.

The Melbourne Australia-based biopharmaceutical company will offer American Depositary Shares each of which will represent eight of the company’s ordinary shares.

Opthea is targeting $160 million in gross proceeds in the offering and is giving underwriters a 30-day option to purchase an additional 15% of the ADSs in the IPO.

The ADSs will be listed on the Nasdaq Stock Market under the symbol “OPT.”

Citigroup Inc (NYSE: C) and SVB Leerink have been appointed as joint book-running managers, while Oppenheimer Holdings Inc (NYSE: OPY)-subsidiary Oppenheimer & Co and Truist Financial Corporation's (NYSE: TFC) division Truist Securities are acting as lead managers.

On Monday, at press-time, the company’s shares traded at $2.18 in Sydney, which would price an ADR at $17.44.

Opthea’s focus is on developing a novel therapy for highly preventable and progressive retinal diseases including wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME).

The company’s lead clinical candidate OPT-302 is under development for use in combination with anti-VEGF-A monotherapies.

The company — founded in 2012 — raked in $1 million in revenue for 12 months ended June 30, according to Renaissance Capital.

Roblox plans an IPO

- Roblox makes freemium games supported with in-app purchases and operates Roblox Studio, a free game creation system that puts the company in competition with recently listed Unity Software (NYSE:U).

- Gaming company announces confidential filing with SEC after revealing earlier this year that it had more than 150 million active users

The company disclosed in a release Monday morning that it has submitted confidential paperwork with the Securities and Exchange Commission pertaining to a potential initial public offering. Roblox hosts child-friendly games focused on digital characters resembling Lego, and has increased in popularity during the COVID-19 pandemic like many other videogames.

Roblox announced in July that it had more than 150 million monthly active users on its platform, which topped the latest numbers from a similar game, “Minecraft.” Microsoft Corp.’s (MSFT) Xbox division announced in May that 126 million people were playing that title each month.

Roblox also offers tools for developers and said in July that its developer community was on pace to earn $250 million in 2020, up from $110 million in 2019.

Games on the Roblox platform include “Adopt Me!,” a virtual-pet title that had over 10 billion plays as of late July, and “Piggy,” which launched in January and had nearly 5 billion visits in just over six months from its launch date.

Monday, October 12, 2020

IPOs this week : October 12 - 16, 20 (wk 42)

- Codiak BioSciences (CDAK),

- Array Technologies (ARRY),

- MINISO Group (MNSO),

- Spinal Elements (SPEL),

- Jupiter Wellness (JUPW) and

- Aziyo Biologics (NASDAQ:AZYO)

- Adaptive Biotechnologies (NASDAQ:ADPT),

- Atreca (NASDAQ:BCEL),

- HeadHunter Group (NASDAQ:HHR) and

- Postal Realty Trust (NYSE:PSTL) on October 14.

- Metacrine (NASDAQ:MTCR), Outset Medical (NASDAQ:OM) and Dyne Therapeutics (NASDAQ:DYN) on October 12, as well as

- Athira Pharma (NASDAQ:ATHA) on October 13.

Thursday, October 8, 2020

China's Lufax files for $3 billion U.S. IPO

(Reuters) - Lufax Holding Ltd, one of China's largest online wealth management platforms, on Wednesday filed to list its shares in the United States, the latest company looking to take advantage of a rebound in capital markets.

Lufax, backed by financial giant Ping An Insurance Group <2318.HK> <601318.SS>, aims to raise about $3 billion in its initial public offering (IPO), which could take place as soon as the end of October, said three people with direct knowledge of the matter.

The sources, who declined to be named as the information was private, added the size of the offering had yet to be finalized and was subject to Lufax's valuation.

The company, which is looking to list its American depositary shares on the New York Stock Exchange, did not disclose the size of the IPO, but set a placeholder amount of $100 million.

Lufax didn't immediately respond to a request for comment on its IPO size and timetable.

Lufax was valued at $38 billion before its latest fundraising in 2018.

The company's filing follows the listing of OneConnect Financial Technology <OCFT.N>, another fintech company backed by Ping An, which raised $312 million in December 2019.

It also comes against the backdrop of a number of Chinese companies looking to reconsider their listings on U.S. exchanges amid rising U.S.-China tensions.

Set up in 2011 as a P2P (peer to peer) platform by Ping An, Lufax has, however, been exiting the once core business as China cracked down on the sector to contain financial risks.

Lufax postponed a Hong Kong listing slated for the first half of 2018 amid uncertainty over China's consumer lending regulation.

The company posted a net profit of 7.27 billion yuan ($1.07 billion) for the six months ended June 30, compared with 7.48 billion yuan a year earlier.

Saturday, October 3, 2020

Aditxt, Inc. (ADTX) : 4-year performance

- Sector: Healthcare

- Industry: Biotechnology

- Full Time Employees: 47

- Founded by Leonard L. Bailey, Shahrokh Shabahang, and Amro Albanna in 2017

- Headquartered in Richmond, Virginia

- https://www.aditxt.com/

Thursday, October 1, 2020

Mission Produce (AVO) began trading on the Nasdaq on Thur 1 Oct 20

- Sector(s): Consumer Defensive

- Industry: Food Distribution

- Full Time Employees: 2,800

- Founded in 1983

- Headquartered in Oxnard, California.

- https://www.missionproduce.com

Pulmonx (LUNG) began trading on the Nasdaq on Thur 1 Oct 20

- Sector(s): Healthcare

- Industry: Medical Devices

- Full Time Employees: 253

- Incorporated in 1995

- Headquartered in Redwood City, California

- https://pulmonx.com