Thursday, August 29, 2019

Ambarella (AMBA) reported earnings on Thur 29 Aug 2019 (a/h)

** charts after earnings **

Ambarella beats by $0.19, beats on revs; guides OctQ revs above consensus

Reports Q2 (Jul) earnings of $0.21 per share, excluding non-recurring items, $0.19 better than the S&P Capital IQ Consensus of $0.02; revenues fell 9.7% year/year to $56.4 mln vs the $52.0 mln S&P Capital IQ Consensus.

Co issues upside guidance for Q3 (Oct), sees Q3 revs of $63-67 mln vs. $55.4 mln S&P Capital IQ Consensus.

Labels:

7-year performance,

AMBA,

earnings,

earnings pops

Dell (DELL) reported earnings on Thur 29 Aug 2019 (a/h)

** charts after earnings **

Dell beats by $0.66, reports revs in-line

Reports Q2 (Jul) adjusted earnings of $2.15 per share, $0.66 better than the S&P Capital IQ Consensus of $1.49; revenues rose 1.9% year/year to $23.37 bln vs the $23.32 bln S&P Capital IQ Consensus.

"We are in the early stages of a technology-led investment cycle. IT spending remains healthy and our business drivers remain strong," said Jeff Clarke, vice chairman, Dell Technologies. "We are innovating and integrating across the Dell Technologies portfolio, from the edge to the core to the cloud, with a diverse business designed to succeed in any macro environment. For example, core Dell orders were up four percent in the quarter excluding China."

Labels:

8-month performance,

DELL,

earnings,

earnings pops

Tallgrass Energy (TGE) receives a buyout offer from Blackstone (BX) for $19.50/sh

- Tallgrass Energy (TEGP) has IPO on 7 May 2015

- Tallgrass Energy (TEGP) acquires Tallgrass Energy Partners (TEP); TEGP change its name to Tallgrass Energy LP and trades on the NYSE under the symbol TGE. 27 March 2018

- Tallgrass Energy (TGE) receives a buyout offer from Blackstone (BX) for $19.50 per share. 27 Aug 2019

- Tallgrass had been trading for $24 recently and plummeted once Blackstone got involved in the first place.

- A questionable side deal with management potentially allows insiders to cash out at $26.25 while the general public gets far less for their shares.

- The situation isn't fully played out yet, Blackstone may have to sweeten their offer to close the deal.

These shareholders, who together already own about a 44.2% stake in Tallgrass including 23.7 million Class A shares, have made a non-binding preliminary proposal to buy Tallgrass' remaining Class A shares at $19.50 per unit, the company said.

The offer represents a 35.9% premium to the company's last close on Tuesday.

The latest transaction will be valued at $3.03 billion based on the number of Class A shares of 179.2 million at the end of July 31, as reported in the company's latest filing.

In January, Blackstone Group LP said it would buy a controlling stake in Tallgrass for $3.3 billion. Tallgrass said https://www.businesswire.com/news/home/20190827005832/en its board intends to form a committee consisting of independent directors to consider the proposal.

Citigroup Inc is the financial adviser and Vinson & Elkins the legal adviser to the midstream energy firm.

Monday, August 26, 2019

IPOs this week : Aug 26 - 30, 19 (wk 35)

IPOs expected to price

No pricings are scheduled during the week as things stay relatively quiet in the IPO market.

IPO lockup expirations

No pricings are scheduled during the week as things stay relatively quiet in the IPO market.

IPO lockup expirations

- IPO lockup periods expire on Super League Gaming (NASDAQ:SLGG) on August 26 and

- Kaleido Biosciences (NASDAQ:KLDO) on August 27.

- IPO quiet period expirations arrive on Dynatrace (NYSE:DT), Borr Drilling (NYSE:BORR), Kura Sushi (NASDAQ:KRUS) and Sundial Growers (NASDAQ:SNDL) on August 26.

Thursday, August 22, 2019

Pivotal Software (PVTL) to be acquired by VMware (VMW) for $15 per share

Pivotal Software (PVTL) to be acquired by VMware (VMW) for $15 per share.

VMware (VMW) signs definitive agreement to acquire Pivotal Software for $11.71 blended price per share; $15 cash per share for public stockholders (enterprise value of $2.7 bln)

VMware will acquire Pivotal for a blended price per share of $11.71, comprised of $15 per share in cash to Class A stockholders, and the exchange of shares of VMware's Class B common stock for shares of Pivotal Class B common stock held by Dell Technologies (DELL), at an exchange ratio of 0.0550 shares of VMware Class B stock for each share of Pivotal Class B stock.

Under the terms of the transaction, Pivotal's Class A common stockholders will receive $15.00 per share cash for each share held, and Pivotal's Class B common stockholder, Dell Technologies, will receive ~7.2 million shares of VMware Class B common stock, at an exchange ratio of 0.0550 shares of VMware Class B common stock for each share of Pivotal Class B common stock. This transaction, in aggregate, results in an expected net cash payout for VMware of $0.8 billion. The impact of equity issued to Dell Technologies would increase its ownership stake in VMware by approximately 0.34 percentage points to 81.09% based on the shares currently outstanding. VMware currently holds 15 percent of fully-diluted outstanding shares of Pivotal. The transaction is expected to be funded through cash on the balance sheet, accessing short-term borrowing capacity, and ~7.2 million shares of VMware Class B common stock to Dell. Closing of the transaction is subject to customary closing conditions including the approval of the merger agreement by the holders of at least a majority of the outstanding shares of Pivotal common stock not owned by VMware or Dell Technologies or their affiliates and is expected in the second half of VMware's fiscal year 2020, which ends January 31, 2020.

** charts before **

GSX Techedu Inc. (GSX) reported earnings on Thur 22 Aug 2019 (b/o)

** charts before earnings **

** after earnings **

Highlights for the Second Quarter Ended June 30, 2019

- Net revenues increased 413.4% year-over-year to RMB353.7 million from RMB68.9 million in the same period of 2018.

- Gross billings increased 462.4% year-over-year to RMB599.4 million from RMB106.6 million in the same period of 2018.

- Gross profit margin increased to 71.4% from 61.4% in the same period of 2018.

- Non-GAAP gross profit margin increased to 72.6% from 61.5% in the same period of 2018.

- Income from operations increased to RMB16.2 million from loss from operations of RMB0.5 million in the same period of 2018.

- Non-GAAP income from operations increased to RMB31.1 million from RMB0.2 million in the same period of 2018.

- Total enrollments increased 250.3% to 592,000 from 169,000 in the same period of 2018.

Highlights for the Six Months Ended June 30, 2019

- Net revenues increased 437.9% year-over-year to RMB622.8 million from RMB115.8 million in the same period of 2018.

- Gross billings increased 436.8% year-over-year to RMB899.5 million from RMB167.6 million in the same period of 2018.

- Gross profit margin increased to 70.6% from 59.2% in the same period of 2018.

- Non-GAAP gross profit margin increased to 71.4% from 59.2% in the same period of 2018.

- Income from operations increased to RMB59.0 million from loss from operations of RMB4.7 million in the same period of 2018.

- Non-GAAP income from operations increased to RMB77.6 million from non-GAAP loss from operations of RMB3.8 million in the same period of 2018.

- Total enrollments increased 234.6% to 803,000 from 240,000 in the same period of 2018.

Carbon Black (CBLK) to be acquired by VMware (VMW) for $26/share

- Carbon Black went public less than a month after Pivotal, and is similar in that it offers cloud software that focuses on securing other companies’ usage of cloud software. Carbon Black sold IPO shares at $19 apiece, but had been trading lower than that level for months before a strong earnings report in May sent shares higher.

VMware (VMW) to acquire Carbon Black for $26/share in cash - representing an enterprise value of $2.1 bln

Under the terms of the Carbon Black merger agreement, Carbon Black stockholders will receive $26 per share cash for each share held, resulting in a net cash payout for VMware of $1.9 billion. The transaction will be funded through cash on the balance sheet and access to short-term borrowing capacity. Closing is expected in the second half of VMware's fiscal year 2020, which ends January 31, 2020.

** charts before **

Wednesday, August 21, 2019

Pinduoduo (PDD) reported earnings on Wed 21 Aug 2019 (b/o)

** charts after earnings **

Pinduoduo beats by $0.15; beats on RMB revs

Reports Q2 (Jun) loss of $0.04 per share, $0.15 better than the S&P Capital IQ Consensus of ($0.19); revenues rose 169.1% year/year to RMB 7.29 bln vs the RMB 6.15 bln S&P Capital IQ Consensus.

GMV in the twelve-month period ended June 30, 2019 was RMB709.1 billion, an increase of 171% from RMB 262.1 billion in the twelve-month period ended June 30, 2018.

Average monthly active users in the quarter were 366.0 million, an increase of 88% from 195.0 million in the same quarter of 2018.

Co also announced the appointment of Anthony Kam Ping Leung to serve as an independent director of the Company, effective on August 21, 2019.

Labels:

1-year performance,

earnings,

earnings pops,

PDD

Saturday, August 17, 2019

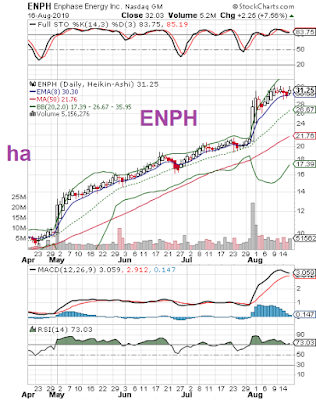

Long trade : Enphase Energy (ENPH) +570% YTD (8/19)

Enphase Energy is a renewable energy company. It designs and manufactures software-driven home energy solutions.

- Sector: Technology

- Industry: Semiconductor Equipment & Materials

- Full Time Employees: 427

- Headquarters: Fremont, California.

- Founded in 2006

- http://www.enphase.com

Labels:

7-year performance,

ENPH,

great long trades

IPOs this week : Aug 19 - 23, 19 (wk 34)

IPO lockup expirations

Keep an eye on Lyft (NASDAQ:LYFT) this week with the company's share lock-up period ending on August 19 instead of September 24. It's not unusual for lock-up periods to end before the 180-day agreement with underwriters and the company, but it could add to trading volatility for Lyft in the week ahead.

IPO quiet period expirations

Meanwhile, quiet period expirations are on tap for Health Catalyst (NASDAQ:HCAT), Livongo Health (NASDAQ:LVGO), ProSight Global (NYSE:PROS), Sunnova Energy (NYSE:NOVA), Castle Biosciences (NASDAQ:CSTL), Wanda Sports (NASDAQ:WSG) and Vista Oil & Gas (NYSE:VIST).

IPOs expected to price

There are no pricings on the calendar for the week ahead, but there could be some more buzz over a potential filing by Postmates (POSTM) and what the implications of that deal are for DoorDash, Uber Eats (NYSE:UBER) and GrubHub (NYSE:GRUB).

Thursday, August 15, 2019

9F Inc. (JFU) began trading on the Nasdaq on Thur 15 Aug 2019

9F Inc. operates an online consumer finance platform that integrates and personalizes financial services in the People's Republic of China.

9F (JFU) priced 8.9 mln ADS IPO at $9.50, the high-end of the expected $7.50-9.50 range

- Sector: Technology

- Industry: Software—Application

- Full Time Employees: 1,649

- Founded in 2006

- Headquartered in Beijing, China.

- http://www.9fgroup.com

Labels:

2019 IPOs,

Chinese IPOs,

financial IPOs,

first day of trading,

JFU,

NASDAQ

CrossFirst Bankshares (CFB) began trading on the Nasdaq on Thur 15 Aug 2019

The company operates seven branches in Kansas, Missouri, Oklahoma, and Texas.

CrossFirst Bankshares opened for trading at $14.50 after pricing IPO at $14.50

CrossFirst Bankshares opened for trading at $14.50 after pricing IPO at $14.50

- Sector: Financial Services

- Industry: Banks—Regional

- Founded in 2007

- Headquartered in Leawood, Kansas

- http://www.crossfirstbank.com

Alibaba (BABA) reported earnings on Thur 15 Aug 2019 (b/o)

** charts before earnings **

** charts after earnings **

Subscribe to:

Posts (Atom)